Business Ideas: 13 Key Elements To Pitch A Great Business Idea To Achieve Success.

Crafting a compelling business idea is crucial when seeking investment. Here’s an in-depth look at what key elements to include when pitching a business idea to potential investors:

Business Ideas:

13 Key Elements To Include In your Business Idea:

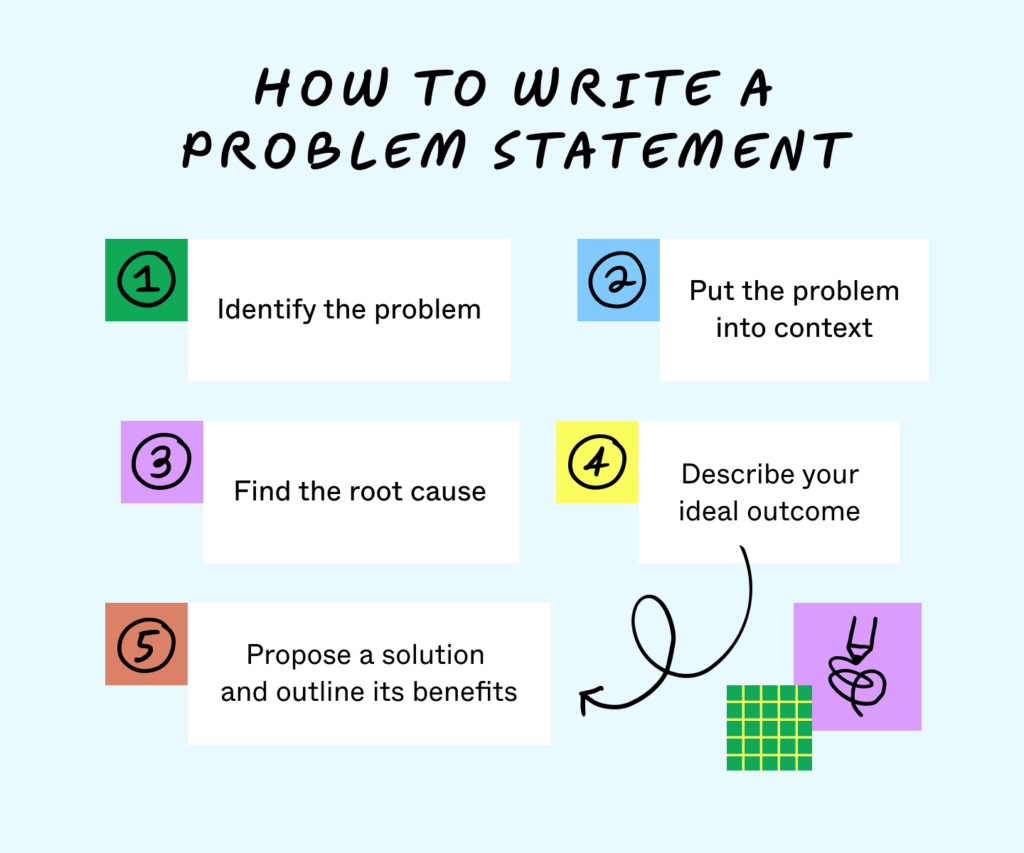

1. Problem Statement:

Clearly define the problem your business aims to solve. Investors are interested in ventures that address genuine pain points or needs in the market. Clearly articulate the problem to create a foundation for the significance of your solution.

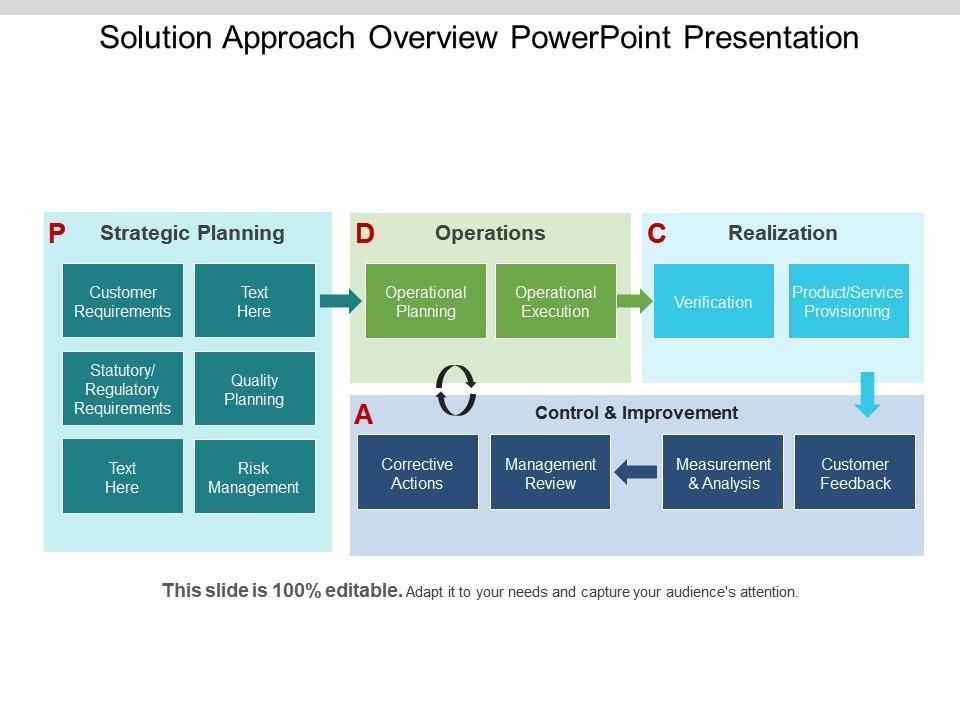

2. Solution Overview:

Present your solution concisely. Explain how your product or service solves the identified problem. Emphasize the unique features that set your solution apart from existing ones and why it is better suited to address the issue.

3. Market Opportunity:

For a great business idea, provide a comprehensive analysis of the market opportunity. Include data on the target audience, market size, and potential for growth. Investors want to see that your business operates in a viable and scalable market.

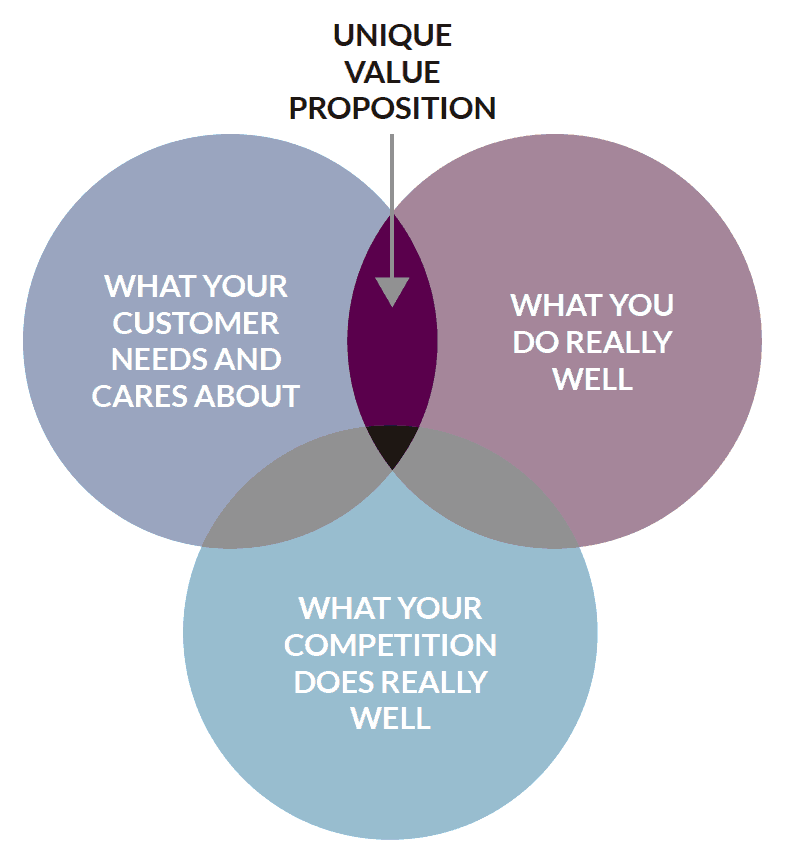

4. Unique Value Proposition (UVP):

Clearly communicate your Unique Value Proposition in your business idea. What makes your product or service stand out? Whether it’s a technological innovation, cost-effectiveness, or a unique approach, your UVP is critical in capturing investor interest.

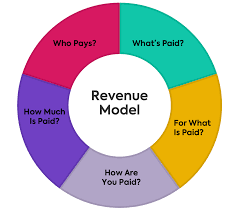

5. Revenue Model:

Outline your revenue model and monetization strategy. Investors want to know how your business will generate income. Whether through product sales, subscription models, or other means, be transparent about how you plan to turn your idea into a profitable venture.

6. Market Validation:

Demonstrate that there is demand for your solution. This could include early sales, partnerships, or positive feedback from potential customers. Investors are more likely to be interested if there is evidence that your idea has real-world traction.

7. Competitive Landscape:

Provide a thorough analysis of your competitors. Identify key players in the market and explain how your business differentiates itself. Understanding your competition and presenting a clear competitive advantage is crucial for investor confidence.r

8. Traction and Milestones:

Highlight any milestones your business has achieved and indicate future milestones. This could include product development stages, user acquisition goals, or revenue targets. Investors want to see a roadmap for success and understand the trajectory of your business.

9. Team Presentation:

Introduce your team and showcase their expertise. Investors often invest in the team as much as the idea itself. Highlight relevant experience, skills, and a shared commitment to the success of the venture.

10. Financial Projections:

Present realistic and well-researched financial projections. Outline your revenue forecasts, expense estimates, and funding requirements. Investors need to see that you have a clear understanding of the financial aspects of your business and a plan for sustainable growth.

11. Risk Mitigation Strategies:

Address potential risks associated with your business and provide strategies for mitigating them. Investors appreciate a proactive approach to risk management, demonstrating that you’ve thought through potential challenges and have plans in place to overcome them.

12. Scalability:

Clearly articulate how your business can scale. Investors are interested in ventures with the potential for significant growth. Discuss expansion plans, target markets, and how you plan to increase your market share over time.

13. Exit Strategy:

Outline potential exit strategies for investors. Whether through acquisition, IPO, or other means, investors want to understand how and when they will see a return on their investment. Providing a clear exit strategy adds a layer of confidence for potential investors.

Remember, the key to a successful pitch lies in a well-structured, well-researched, and passionate presentation. Tailor your pitch to your audience, showcasing both the potential of your business idea and the competence of your team.

Engage investors by demonstrating not only the profitability of your venture but also its long-term sustainability and societal impact.

10 Things To Do Before Presenting A Business Idea:

1. Thorough Market Research:

Before presenting your business ideas, conduct comprehensive market research to understand industry trends, potential competitors, and your target audience. Investors want to see that you have a deep understanding of the market and have identified a unique value proposition.

2. Clear Business Plan:

Develop a well-structured business plan that outlines your company’s mission, vision, and detailed strategies. Include financial projections, a marketing plan, and a roadmap for growth. Investors need a clear roadmap to see how their investment will contribute to the success of the business.

3. Financial Preparedness:

Be prepared to discuss your financials, including revenue projections, cost structures, and funding requirements. Investors want to ensure that your business is financially viable and that their investment will yield returns.

4. Unique Value Proposition:

Clearly articulate your unique value proposition. What sets your business apart? Investors are more likely to invest if they see a distinctive element that gives your business a competitive edge.

5. Team Presentation:

Introduce your team and highlight their expertise and experience. Investors often invest in the team as much as the idea. Showcase how your team’s skills complement each other and demonstrate a strong capability to execute the business plan.

6. Mitigate Risks:

Address potential risks associated with your business and provide strategies to mitigate them. Investors appreciate a well-thought-out risk management plan, showing that you’ve considered possible challenges and have plans in place to navigate them.

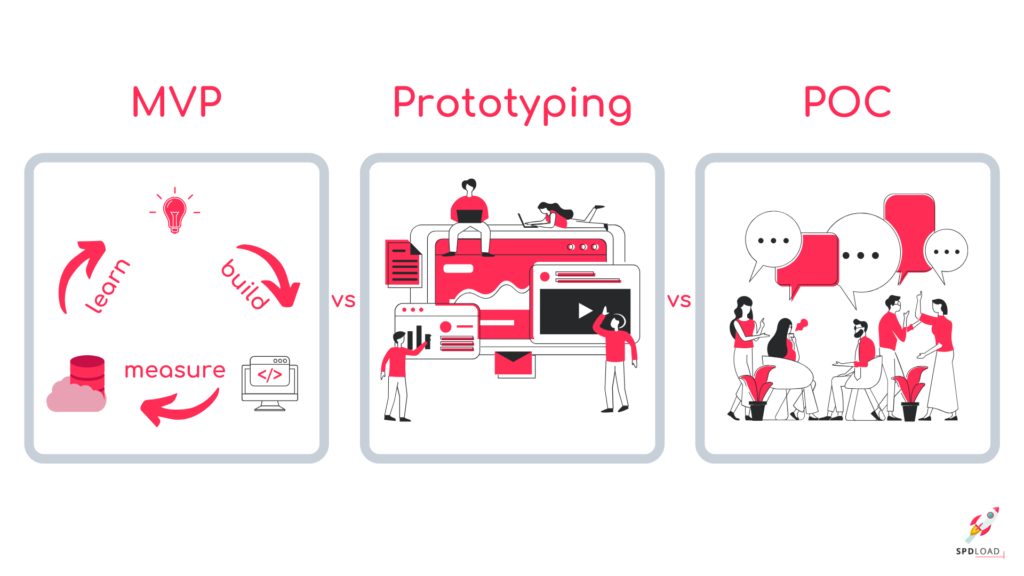

7. Prototype or MVP:

If applicable, showcase a prototype or minimum viable product (MVP) to demonstrate the feasibility and potential success of your business idea. This tangible evidence can significantly enhance your pitch.

8. Effective Communication Skills:

Hone your presentation and communication skills. Practice your pitch to ensure clarity, confidence, and a concise delivery. Be ready to answer questions with poise, demonstrating your in-depth knowledge and passion for your business.

9. Legal and Compliance Considerations:

Address legal and compliance aspects of your business. Investors want to ensure that your business operates within the legal framework and is compliant with industry regulations.

10. Networking and Relationship Building:

Build relationships with potential investors before presenting your ideas formally. Attend networking events, engage with industry experts, and seek mentorship. Establishing a connection beforehand can create a positive impression and increase the likelihood of investment.

Remember, preparation and professionalism are key when presenting your business ideas to investors. Tailor your presentation to resonate with your audience, addressing their concerns and showcasing the potential for mutual success.